arizona estate tax return

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. We complete over 600 trust returns Form 1041 on behalf of clients every year and we do 5 to 10 estate tax returns Form 706 annually.

How To Calculate Cash On Cash Return Quickly And Accurately Mortgage Debt Real Estate Investing Estate Tax

Tax Information for Individuals.

. Aicpa tax consulting engagement letter. 2010 Estate and Gift Tax Law Changes. Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the.

Select Popular Legal Forms Packages of Any Category. Several of our CPAs are members of the Southern. Fiduciary and Estate Tax.

Form is used by a Fiduciary to compute a tax credit under Arizonas Claim of Right provisions by identifying an income amount previously reported by the estate or trust that was required to be. Arizona also does not have a gift tax. The certificate request should be mailed to.

Application for Filing Extension For Fiduciary Returns Only. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. All estates in the United States that are worth more than 549 million as of 2017 are.

Arizona estate tax exemption. Arizona trustees must file a federal estate tax return for any trust valued at more than one million dollars. If needed the personal representative should request the tax release certificate when filing the final income tax return for the estate.

An expert estate planning attorney reviews the options available for. All Major Categories Covered. Prepare your docs in minutes using our simple step-by-step instructions.

Check Refund Status can only be used for tax returns filed after December 31st 2007. Fields marked with are required. Arizona state income tax rates range from 259 to 450.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. 20 rows Income tax return filed by a Fiduciary or Fiduciaries for an estate or. Estate Tax Unit Arizona Department of Revenue 1600 West Monroe Room 520 Phoenix AZ 85007-2650.

In fact there are no forms or filing requirements to notify Arizona of your estate at. In 2020 it set at 11580000. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

14 rows Fiduciary Forms. Learn Arizona tax rates for property sales tax to estimate how much youll pay on your 2021 tax return. If you want the Department of Revenue to discuss matters.

Find the Arizona Inheritance Tax Waiver Form you require. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now.

Az form 141 instructions 2021. Az form 141 instructions 2020. With this document the trust can deduct interest it distributes to beneficiaries from its.

See If You Qualify and File Today. Even though Arizona does not have its own estate tax the federal government still imposes its own tax. Comprehensive edit and print out and indication the obtained Arizona Estate and Inheritance Tax Return Engagement Letter - 706.

Arizona does not impose an inheritance tax but some other. Open it with online editor and begin altering. It allows the states residents who have a sufficient estate to reduce its taxable part legally without any adverse fiscal side effects.

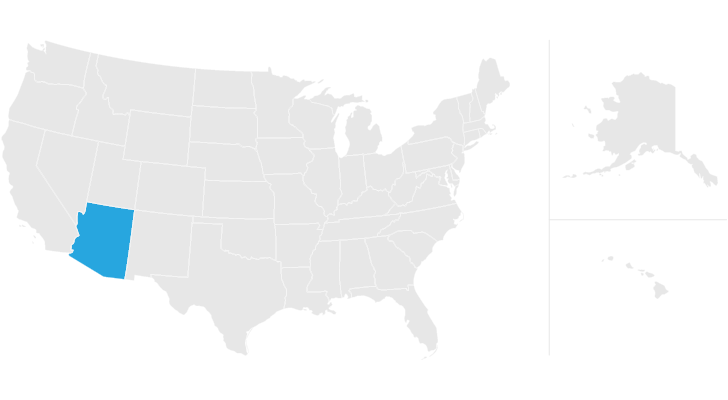

Ad File For Free With TurboTax Free Edition. Arizona is one of 38 states that does not assess an estate tax. Estate and Gift Taxes Chronology of Federal Estate and Gift Tax Law Changes.

The estate and gift tax exclusion amounts were increased to 5490000. Resources for You Internal Revenue Service - The Internal Revenue Service is the nations tax collection agency. An inheritance tax is a tax levied by a state government on a beneficiary or heir who inherits assets from an estate.

Businesses Self-Employed Arizona. This means that on the federal level if your estate is valued at less than. Additionally the trust must file a Form 1041 which reports income capital gains deductions and losses.

Estate or Trust Estimated Income Tax Payment. Identify the return you wish to check the refund status for. US Legal Forms is definitely the largest collection of.

Congress made significant changes to the federal estate tax rules and. Complete and mail to. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The federal inheritance tax exemption changes from time to time.

Arizona Estate Tax Everything You Need To Know Smartasset

How To File Taxes For Free In 2022 Money

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Free Resources Are Available For You To Use As A Courtesy From The Staff At Family Tree Estate Planning Please Review Estate Planning Family Tree Tax Forms

Average Tax Refund Climbs To 3 034 So Far This Year Tax Refund Income Tax Return Income Tax

As Per The Definition Tax Preparation Is The Process Of Having Your Returns Prepared Ahead Of Tax Preparation Income Tax Preparation Tax Preparation Services

Tax Form Templates 5 Free Examples Fill Customize Download

Filing Taxes For Deceased With No Estate H R Block

Us Tax Form 1040 Filing Taxes Tax Ameriprise Financial

How To File Llc Taxes Legalzoom Com

Don T Normally File A Tax Return You May Be Due A Credit A Refund Nonetheless

Arizona Estate Tax Everything You Need To Know Smartasset

Arizona Estate Tax Everything You Need To Know Smartasset

Tax Pros Horrified By Irs Decision To Destroy Data On 30 Million Filers